What is open banking. What is open banking.

Open Banking Banking Apis Explained W Examples

The Committee delivered a consultation document in January 2019 which identified the potential benefits and risks of.

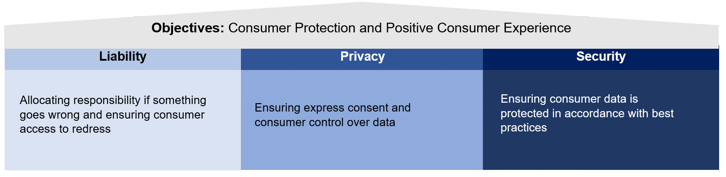

Finance canada open banking. Putting security and privacy at the heart of open banking. In January the Department of Finance. In a nutshell opening banking is a regulatory framework that would allow consumers to determine how to share their banking data with financial service providers or move their information from one institution.

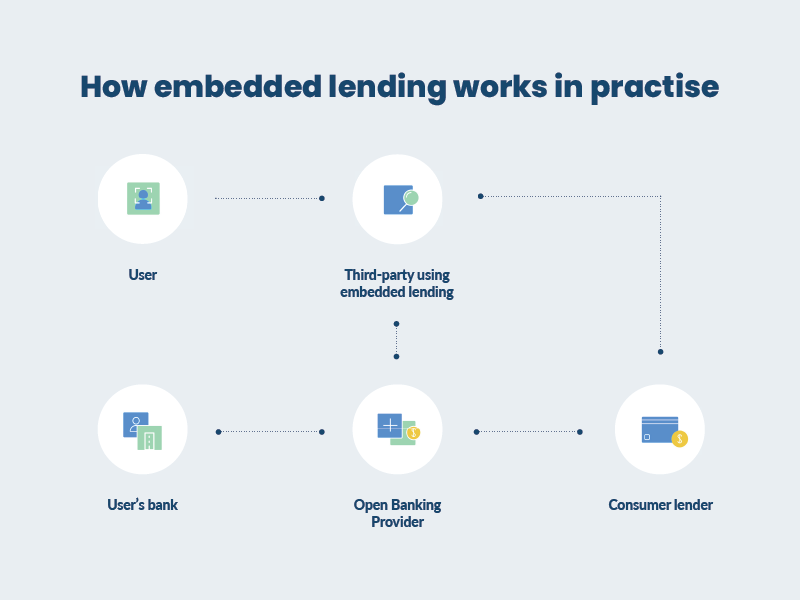

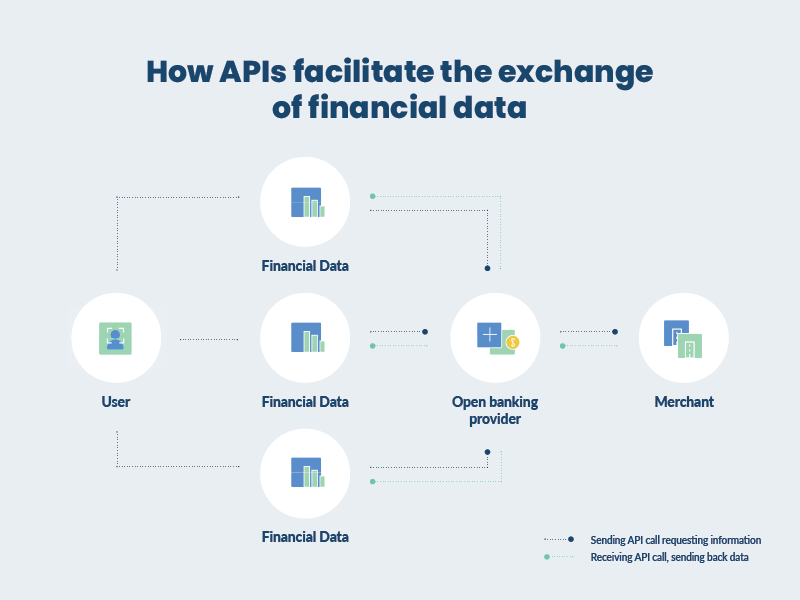

In a recent consultation paper by the Canadian Department of Finance the Consultation Paper the term open banking is described as a framework where consumers and businesses can authorize third party financial service providers to access their financial transaction data using secure online channels. If it becomes available open banking could increase consumer choice and improve financial outcomes for Canadians. Canadas Department of Finance released a consultation paper earlier in 2019 to examine the merits of introducing an open banking framework in Canada.

Canadians deserve a secure open banking system that is safe regulated efficient and protects their interests. Open banking is a global movement that promotes a customers right to share financial information with third parties. The Financial Posts Stefanie Marotta breaks it down.

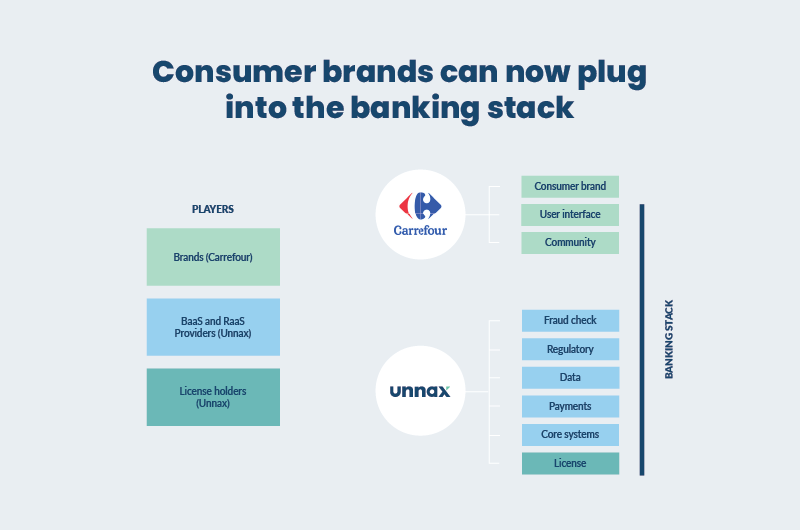

Open banking is a framework that can promote a vibrant and more diverse ecosystem of financial services providers including enhanced roles for FinTechs and small and mid-sized financial service providers. Meanwhile open banking remains an elusive term to most Canadians. This same approach will be adopted by the government as it moves forward with open banking.

Why Canada needs open banking. While many global jurisdictions have legislated open banking policies open banking is broader than just policyits a movement. Open Banking in Canada is driving greater competition in the financial services sector that will not only improve consumers financial wellbeing but also create a virtuous circle.

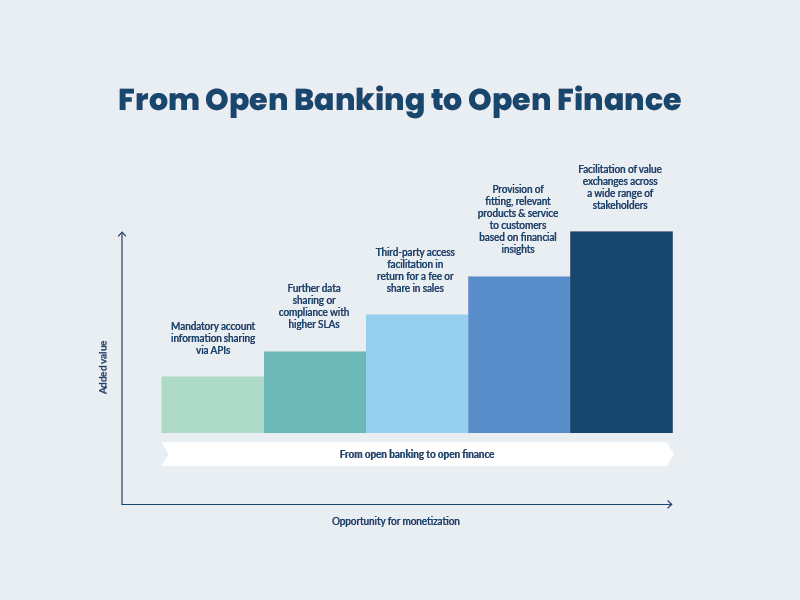

Open banking can connect families with a broader range of budgeting or savings tools and provide financially marginalized Canadians access to low cost automated support to manage their finances. Going beyond open banking we are also beginning to hear talk of open finance which would expand the concept of open banking beyond bank accounts to for example savings pensions insurance and mortgages. The benefit for the Canadian financial services ecosystem will bring new consumers previously out of the traditional target market and enhance the overall experience as well as the broader economy.

Creating an open banking framework for Canada Introduction. How Canadian banks can prepare for open banking. Open banking is not yet available in Canada.

It gives you greater control over your financial data. Open banking is coming to Canada and will have a profound impact on consumers and the financial ecosystem. In particular Canada continues to make steady efforts towards adopting a workable Open Banking framework.

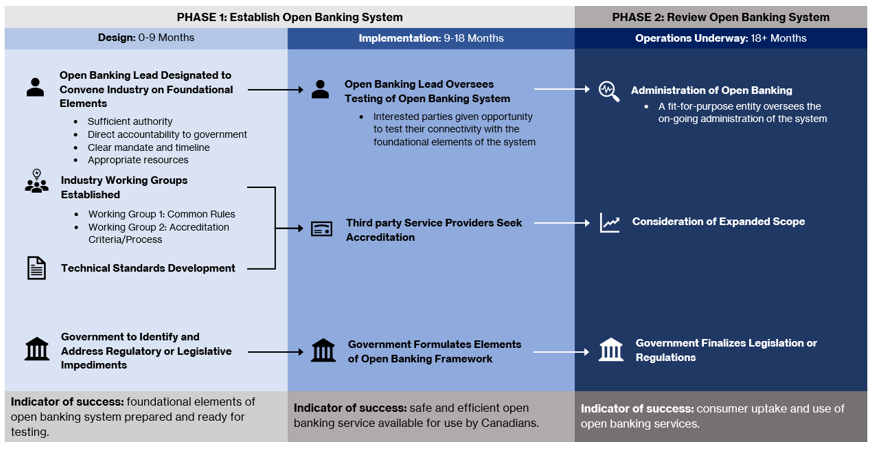

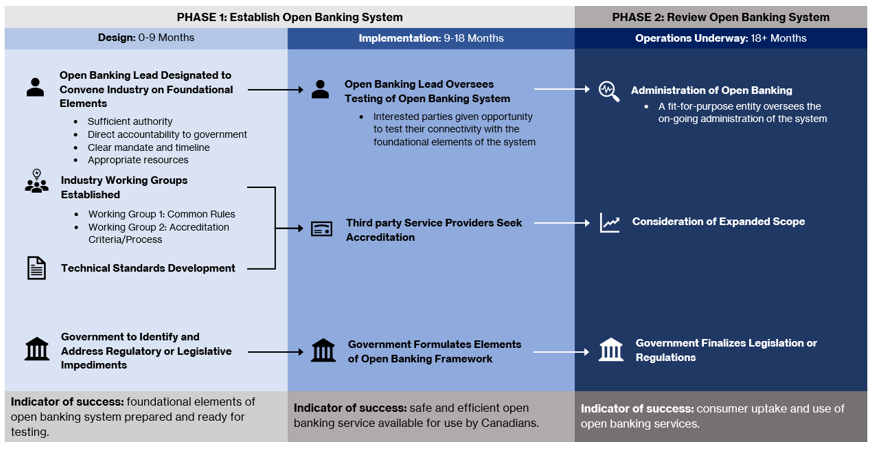

Creating an open banking framework for Canada Considerations and implications of key design choices To reap the benefits of open banking without exposing consumersand the financial system as a wholeto undue risk stakeholders must carefully consider how to design an open banking framework for Canada. This paper explores how. As Canada explores open banking Canadian banks have several options for getting ready for what may come.

The government is committed to safeguarding the privacy of Canadians and ensuring they have control over their own data. As many as four million Canadians use financial service providers that require screen-scraping while waiting for an open banking regime Open banking has been on the federal governments radar for years. Open banking would increase financial sector competition resulting in better products for consumers.

An open banking framework would give Canadians more control over their financial data enabling them to easily and securely share their data with third parties. Using fintech apps with open banking can help improve how you manage your finances online and through mobile devices. Open banking can enable Canadians with limited credit history including newcomers access to credit based on their financial transaction history.

In its 2018 budget the federal government announced that it was establishing a committee to explore the merits of. Open banking has the potential to offer a secure way for Canadian consumersincluding small businessesto consent to sharing their financial transaction data with financial service providers allowing them to benefit from a broader range of financial products and services. Open banking can increase consumer choice and improve financial outcomes for Canadians.

Prime Minister Justin Trudeaus government said in its February 2018 budget that it would review the merits of open banking. Canadas Department of Finance established an Consulting Committee on Open Banking in September 2018 to explore the potential and pitfalls of open banking for consumers. Open banking is coming Canadian Banks 2019 Open banking is coming to Canada and will have a profound impact on consumers and the financial services ecosystem.

So what is it and why does it matter. On May 7th Canada 2020 convened a five-hour policy lab on Open Banking an idea proposed in Budget 2018 by Finance Minister Bill Morneau. Open Banking has the potential to radically transform the banking sector by increasing consumers access to.

Everything You Need To Know About Embedded Finance

Open Banking Australia All Your Pressing Questions Answered

Everything You Need To Know About Embedded Finance

Everything You Need To Know About Embedded Finance

Final Report Advisory Committee On Open Banking Canada Ca

Open Banking Banking Apis Explained W Examples

Banking Industry 2021 Overview Trends Analysis Of Banking Sector

Top Key Facts About Open Banking Open Banking Banking Financial Literacy

Finextra Open Apis Related Fintech News

Open Banking Australia All Your Pressing Questions Answered

Focus Banks And Consumers Focus Banks And Consumers

A Review Into The Merits Of Open Banking Canada Ca

Final Report Advisory Committee On Open Banking Canada Ca

Open Banking Banking Apis Explained W Examples